Arbeitspapier

The Tax Sensitivity of Debt in Multinationals: A Review

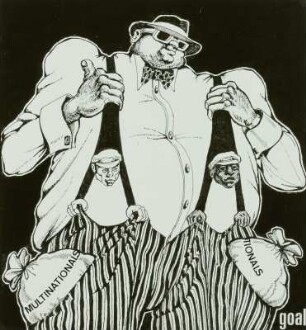

The OECD in its BEPS action plan 4 addresses tax base erosion by profit shifting through the use of tax deductible interest payments. Their main concern is interest deductions between outbound and inbound investment by groups. Studies of multinational firms show that the tax sensitivity of debt is more modest than what one would expect given the incentives for profit shifting. The purpose of this paper is to review existing literature and to add new knowledge on multinational firm behavior that pertains to the use of debt.

- Sprache

-

Englisch

- Erschienen in

-

Series: CESifo Working Paper ; No. 5590

- Klassifikation

-

Wirtschaft

Business Taxes and Subsidies including sales and value-added (VAT)

Financing Policy; Financial Risk and Risk Management; Capital and Ownership Structure; Value of Firms; Goodwill

Multinational Firms; International Business

- Thema

-

corporate taxation

multinationals

capital structure

international debt-shifting

tax avoidance

- Ereignis

-

Geistige Schöpfung

- (wer)

-

Schjelderup, Guttorm

- Ereignis

-

Veröffentlichung

- (wer)

-

Center for Economic Studies and ifo Institute (CESifo)

- (wo)

-

Munich

- (wann)

-

2015

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:42 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Arbeitspapier

Beteiligte

- Schjelderup, Guttorm

- Center for Economic Studies and ifo Institute (CESifo)

Entstanden

- 2015