Arbeitspapier

How Do Corporate Tax Hikes Affect Investment Allocation within Multinationals?

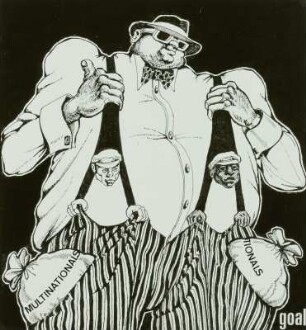

This paper studies how corporate tax hikes transmit across countries through multinationals' internal networks of subsidiaries. We build a parsimonious multicountry model to underscore two opposing spillover effects: While tax competition between countries generates positive investment spillover, intra-firm production linkages predict negative spillover. Using subsidiary-level data and exogenous corporate tax hikes, we find that local business units cut investment by 0.4% for a 1% increase in foreign corporate tax. This result highlights the importance of production linkages in propagating foreign tax shocks, as the supply-chain-induced negative spillover dominates the positive spillover effect suggested by the conventional wisdom of tax competition.

- Sprache

-

Englisch

- Erschienen in

-

Series: CESifo Working Paper ; No. 10272

- Klassifikation

-

Wirtschaft

- Thema

-

tax hike

investment

internal networks

multinationals

spillover effects

- Ereignis

-

Geistige Schöpfung

- (wer)

-

De Vito, Antonio

Jacob, Martin

Schindler, Dirk

Xu, Guosong

- Ereignis

-

Veröffentlichung

- (wer)

-

Center for Economic Studies and ifo Institute (CESifo)

- (wo)

-

Munich

- (wann)

-

2023

- Handle

- Letzte Aktualisierung

-

10.03.2025, 11:43 MEZ

Datenpartner

ZBW - Deutsche Zentralbibliothek für Wirtschaftswissenschaften - Leibniz-Informationszentrum Wirtschaft. Bei Fragen zum Objekt wenden Sie sich bitte an den Datenpartner.

Objekttyp

- Arbeitspapier

Beteiligte

- De Vito, Antonio

- Jacob, Martin

- Schindler, Dirk

- Xu, Guosong

- Center for Economic Studies and ifo Institute (CESifo)

Entstanden

- 2023